Introduction to Real Estate Investment

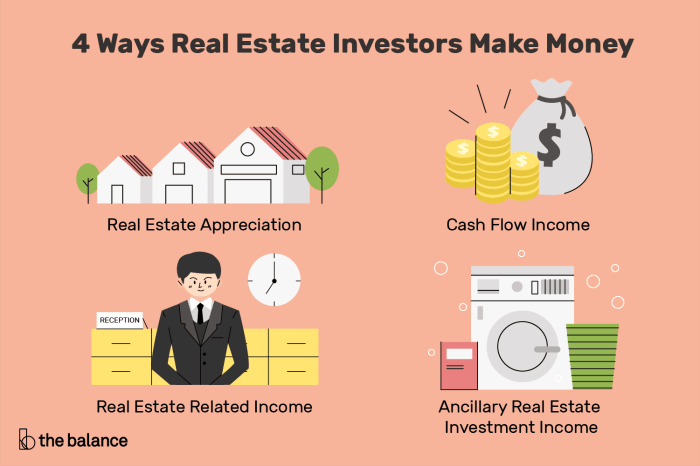

Real estate investment involves purchasing, owning, managing, renting, or selling real estate properties with the aim of generating profit. This type of investment can include residential, commercial, or industrial properties.Real estate is a popular investment choice due to its potential for long-term wealth creation, diversification of investment portfolios, and the opportunity to earn passive income through rental payments.

Additionally, real estate has historically shown appreciation in value over time, making it a relatively stable investment option compared to other asset classes.

Potential Benefits of Investing in Real Estate

- Income Generation: Real estate investments can provide a steady stream of income through rental payments from tenants.

- Appreciation: Properties have the potential to increase in value over time, allowing investors to build equity and wealth.

- Tax Benefits: Real estate investors can take advantage of tax deductions on mortgage interest, property taxes, depreciation, and other expenses related to owning and managing properties.

- Diversification: Investing in real estate can help diversify an investment portfolio, reducing overall risk by spreading investments across different asset classes.

- Leverage: Real estate investments can be leveraged through mortgage financing, allowing investors to control a larger asset with a smaller initial investment.

Types of Real Estate Investments

Investing in real estate offers a variety of options for beginners looking to enter the market. Understanding the different types of real estate investments and their pros and cons can help you make informed decisions to achieve your financial goals.

Residential Real Estate

Residential real estate involves properties used for living purposes, such as single-family homes, apartments, and condominiums.

- Pros:

- Potential for steady rental income

- Lower vacancy rates compared to commercial properties

- Cons:

- Property management responsibilities can be time-consuming

- Market fluctuations can impact property value

Commercial Real Estate

Commercial real estate includes properties used for business purposes, such as office buildings, retail spaces, and warehouses.

- Pros:

- Higher rental income potential compared to residential properties

- Longer lease terms with tenants

- Cons:

- Greater market volatility and economic factors can affect occupancy rates

- Initial investment costs can be higher

Industrial Real Estate

Industrial real estate comprises properties used for manufacturing, production, or storage purposes, such as factories and distribution centers.

- Pros:

- Stable and long-term tenants with established businesses

- Potential for higher rental yields

- Cons:

- Specialized knowledge required for property management

- Market sensitivity to economic changes and industry trends

Short-term vs. Long-term Real Estate Investments

When considering real estate investments, it’s essential to differentiate between short-term and long-term strategies.

- Short-term Investments:

- Involve buying and selling properties quickly for profit

- May require renovation or flipping to increase value

- Long-term Investments:

- Focus on buying and holding properties for rental income or appreciation

- Offer potential for passive income and long-term wealth accumulation

Financial Planning for Real Estate Investment

Investing in real estate requires careful financial planning to ensure success. This includes setting a budget, understanding ROI, and securing financing.

Setting a Budget

Before diving into real estate investment, it is crucial to establish a budget. Determine how much you can afford to invest without compromising your financial stability. Consider factors such as property prices, maintenance costs, and potential renovations.

Understanding ROI

Return on Investment (ROI) is a key metric in real estate investment. It measures the profitability of an investment relative to its cost. To calculate ROI, use the formula:

ROI = (Gain from Investment

Cost of Investment) / Cost of Investment

Understanding ROI helps investors make informed decisions and assess the potential returns of a property.

Securing Financing

Securing financing is crucial for real estate investment, especially for beginners. Consider options such as traditional mortgages, private lenders, or partnerships. Improve your credit score, research different loan options, and compare interest rates to find the best financing solution for your investment.

Research and Due Diligence

Thorough research and due diligence are essential steps before investing in real estate. These processes help investors make informed decisions and minimize risks associated with property investments.

Factors to Consider During Property Evaluation

When evaluating a property for investment, several factors must be taken into consideration:

- Location: The location of the property plays a crucial role in its potential for appreciation and rental income. Factors such as proximity to amenities, schools, transportation, and future development plans can impact the property’s value.

- Market Trends: Understanding the current market trends, including supply and demand dynamics, average rental yields, and property appreciation rates, can help investors gauge the profitability of their investment.

- Potential for Growth: Assessing the potential for future growth in the property’s value and rental income is vital. Factors like infrastructure development, job opportunities, and population growth in the area can indicate the property’s long-term investment potential.

Tips on Conducting Due Diligence Before Purchase

Prior to making a purchase, investors should conduct thorough due diligence to mitigate risks and ensure a successful investment:

- Inspect the Property: Conduct a physical inspection of the property to assess its condition, identify any potential issues, and estimate repair costs.

- Review Financials: Analyze the property’s financial performance, including rental income, expenses, and potential returns on investment. Consider hiring a professional to review financial documents.

- Research Legal Matters: Ensure there are no legal issues or disputes associated with the property, such as liens, zoning violations, or pending lawsuits.

- Consult Experts: Seek advice from real estate agents, property managers, financial advisors, and legal professionals to gain insights and guidance on the investment.

Real Estate Investment Strategies

Investing in real estate offers various strategies for beginners to consider. Each strategy comes with its own set of advantages and challenges, so it’s essential to understand them before diving in. By implementing a diversified real estate investment portfolio, you can mitigate risks and maximize returns.

Buy and Hold Strategy

- Buy and hold strategy involves purchasing properties with the intention of holding onto them for an extended period.

- Advantages include passive income from rental payments, potential appreciation in property value over time, and tax benefits such as depreciation deductions.

- Challenges may include property maintenance costs, dealing with tenants, and market fluctuations affecting property values.

Fix and Flip Strategy

- The fix and flip strategy involves purchasing properties that need renovations, improving them, and selling them for a profit.

- Advantages include the potential for quick returns on investment, gaining valuable experience in property renovations, and the satisfaction of transforming properties.

- Challenges may include unexpected renovation costs, longer holding periods if the property doesn’t sell quickly, and market conditions affecting resale prices.

Rental Properties Strategy

- Rental properties involve purchasing properties to rent out to tenants for regular rental income.

- Advantages include consistent cash flow from rental payments, long-term appreciation potential, and tax benefits such as deductions for expenses.

- Challenges may include tenant turnover, property management responsibilities, and potential vacancies affecting rental income.

Ultimate Conclusion

In conclusion, real estate investment offers a myriad of opportunities for beginners willing to learn and adapt in this dynamic field. By applying the tips and insights shared in this guide, you can embark on your investment journey with confidence and strategic foresight.

Remember, success in real estate investment is a result of informed decisions and calculated risks. Cheers to your future success in the world of real estate investing!

Q&A

What is the best type of real estate investment for beginners?

For beginners, starting with residential real estate investments is often recommended due to lower barriers to entry and potential for steady rental income.

How can beginners secure financing for real estate investments?

Beginners can explore options like mortgage loans, partnerships, or crowdfunding platforms to secure financing for their real estate ventures.

What factors should beginners consider before investing in a property?

Location, market trends, potential for growth, and property condition are crucial factors that beginners should carefully evaluate before making an investment.

Is it better to focus on short-term or long-term real estate investments as a beginner?

As a beginner, it’s advisable to start with a mix of short-term and long-term investments to diversify your portfolio and minimize risks.